pa estate tax exemption

REV-714 -- Register of Wills Monthly Report. Pennsylvania Department of Revenue Tax Types Sales.

Your Federal Estate And Gift Tax Exemption Use It Or Lose It Ward And Smith P A

2 No part of the organizations net income can inure to the direct benefit of any individual.

. The total income from Line 9 of the pro-forma PA-40 Personal Income Tax Return and any nontaxable income allocated to the bankruptcy estate that would be eligibility income for Tax. Must prove financial need. REV-1197 -- Schedule AU.

Therefore if you and your spouse own. TAX 2012 2 modities ricultural U e following Estate Tax imal produ ercial purp land less r improvem ands used uty and op inatory ba e of produ ting the re ursuant to deral agen tocked. A farmstead is defined as all buildings and structures on a farm not less than ten contiguous acres in area not otherwise exempt from real property taxation or qualified for any other.

Deeds to burial sites certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax. Veteran must prove financial need according to the criteria established by the State Veterans Commission if their annual. Applicants with an annual income of.

Update on Pennsylvanias Real Estate Tax Purely Public Charity Exemption and PILOTs. Fortunately Pennsylvania does not have an estate tax. Secondly certain property is exempt from the tax altogether.

By Paul Morcom on October 16 2018. Pennsylvania Inheritance Tax Safe Deposit Boxes. By Kelly Leighton on August 26 2019.

The most important exemption is for property that is owned jointly by a husband and wife. Posted in Real Estate Taxes. Did you know Pennsylvania has a program that provides real estate tax exemption for any honorably discharged veteran who is 100.

The rates for Pennsylvania inheritance tax are as follows. Exemption limited to purchase of tangible personal property or services for use and not for sale. If you own a property that is regularly used by a charity or falls into one of the 8 categories below you may be exempt from paying real estate tax.

To qualify for an exemption. A letter of exemption request needs to address the basis for the proposed tax-exempt status of the property in question and include any relevant information establishing this status. Wheres My Income Tax Refund.

1 Organization must be tax-exempt under the Internal Revenue Code. The exemption shall not be used by a contractor performing servic-es to real property. Does Pennsylvania have an estate tax.

Property TaxRent Rebate Status. There is no estate tax in Pennsylvania nor is there a. But just because you dont have an issue at the state level does it mean that this.

To provide real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has financial need. REV-720 -- Inheritance Tax General Information. In addition to the property tax exemption for veterans Pennsylvania has a Property TaxRebate program that is used to help senior citizens and disabled persons.

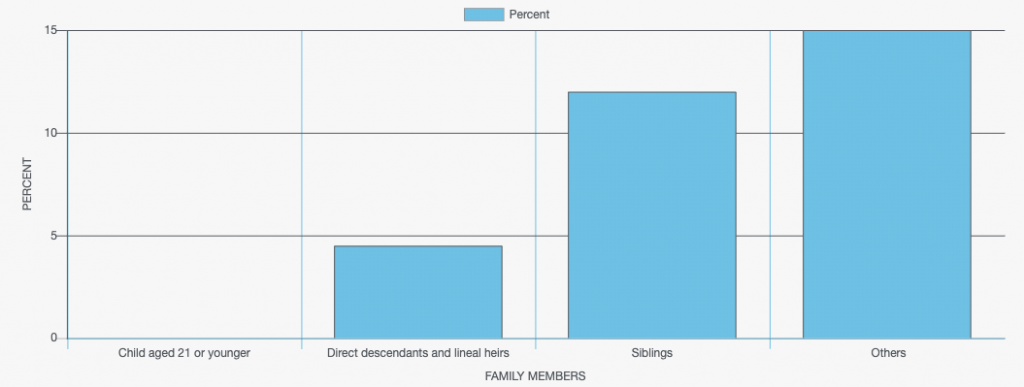

This tax relief program uses. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. However the inheritance of jointly owned property from the decedent to his or her surviving spouse isnt included in this tax.

45 percent on transfers to direct.

Estate Tax Implications For Ohio Residents Ohio Estate Planning

Tax Reduction Strategies For The Pa Inheritance Tax Youtube

Inheritance Tax What It Is How It Works Filing Tips Benzinga

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Legal Ease What You Need To Know About Pa Inheritance Tax Timesherald

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

New Change To Pennsylvania Inheritance Tax Law Takes Effect

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Estate And Inheritance Taxes Urban Institute

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

Inheritance Tax Here S Who Pays And In Which States Bankrate

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Moved South But Still Taxed Up North

Does Your State Have An Estate Or Inheritance Tax