refund for unemployment taxes 2020

Taxpayers can expect to receive a refund of 1265 on average. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

Did You Receive Unemployment Benefits In 2020 The Irs Might Surprise You With A Refund In November

Tax refunds on unemployment benefits to start in May.

. The IRS has sent 87 million unemployment compensation refunds so far. Here is more information about unemployment tax. Recalculated taxes on 2020 unemployment benefits.

We have begun mailing 2021 Senior Freeze Property Tax Reimbursement checks to applicants who filed before May 1 2022. The deadline for filing your ANCHOR benefit application is December 30 2022. A direct deposit amount will likely.

Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 Connecticut calls outside the Greater Hartford calling area only or 860-297. Where is unemployment tax refund. Refunds will go out as a direct deposit if you provided bank account information on your 2020 tax return.

I foolishly filed my tax return on the day they passed the legislation that excluded the first 10200 of unemployment income from federal taxes. The tax rate for a start-up entrepreneur is 10 for the first year of liability 11 for the second year of liability and 12. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

The refunds will happen in two waves. The American Rescue Plan ARP signed by President Joe Biden in March excluded up to 10200 in 2020. During a normal year unemployment benefits are taxed as regular income which means youll need to pay income.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. Most recent status updated Sept 16 2022 IRS says. If you received unemployment benefits in 2020 a tax refund may be on its way to you.

Taxpayers eligible for the up to 10200 exclusion who have already filed 2020 taxes claiming their unemployment insurance benefits. For taxpayers who already have filed and figured their 2020 tax based on the full amount of unemployment compensation the IRS will determine the correct taxable amount of. You are eligible for a property tax deduction or a property tax credit only if.

The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your. They say dont file an amended return. Some refunds that are requested as Direct Deposit may be converted to paper check and mailed to the taxpayers address as a method of verifying that the refund is legitimate.

New income calculation and unemployment. Property Tax Relief Programs. We will mail checks to qualified applicants as.

We will begin paying ANCHOR. IRS continues to review tax year 2020 returns and process corrections for taxpayers who paid. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits The Motley Fool

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Freetaxusa Federal State Income Tax Calculator Estimate Your Irs Refund Or Taxes Owed

Your Tax Refund May Be Late The Irs Just Explained Why The Washington Post

Irs Is Sending Unemployment Tax Refund Checks This Week Money

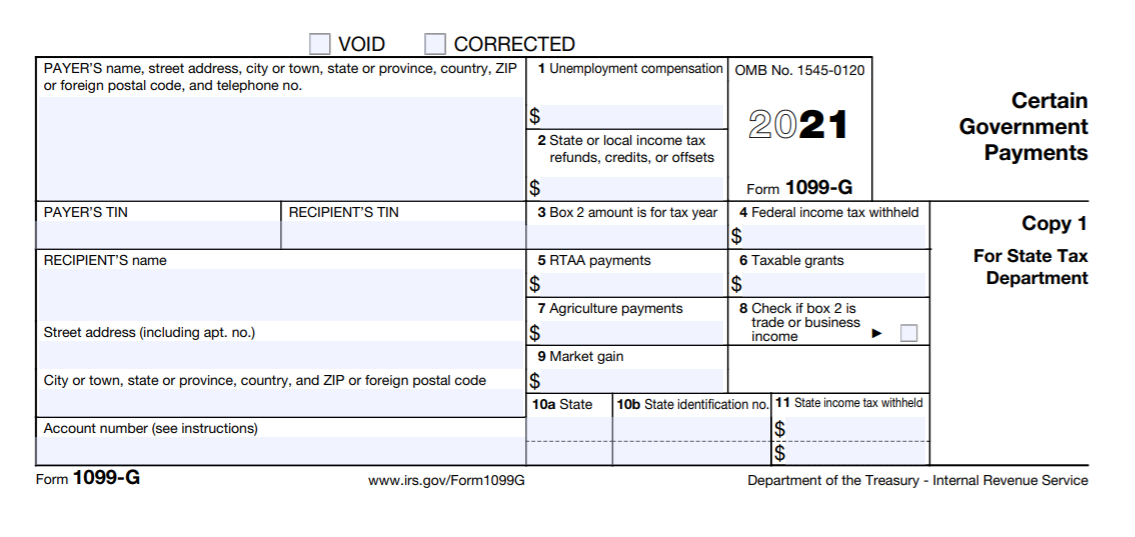

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Tax Free Unemployment Change Could Require Amended Tax Return Filings Don T Mess With Taxes

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Pennsylvania Department Of Revenue Announces 1 Month Extension To File 2020 Income Tax Returns Fox43 Com

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Irsnews On Twitter Irs To Recalculate Taxes On Unemployment Benefits Money Will Be Automatically Refunded This Spring And Summer To People Who Filed Their 2020 Tax Return Before The Recent Changes Made

Indiana Issues New Tax Guidance For 2020 Unemployment Benefits

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Unemployment Tax Refund Update What Is Irs Treas 310 Kare11 Com

Millions Might Get A Refund With The 10 200 Unemployment Tax Break But Filing An Amended Return Could Unlock Even More Money Marketwatch

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break